Are you afraid of the word budget? Unfortunately, many people put off this important financial activity for too long because of the fear and other negative sentiments associated with it.

Budgeting is one of the biggest and most important keys to getting the most out of your money. You do not have to associate the term budget with the hassle, headaches, or restrictions on your ability to spend money as you, please.

Budgeting can make it possible for you to spend more money on the things that matter to you!

When you learn how to make the most of your money, you enable your money to work for you.

Below are some reasons to start this beneficial budgeting activity today to reap significant financial rewards. This list of reasons will help you see the budget in a new light and change your perception of it.

1. Budgeting is simple and flexible

Budgeting can meet your needs no matter what they are as long as you're willing to be flexible. Set money aside for savings, and then let your budget be flexible in meeting your other financial needs for the best results. Change your budget as your need vary.

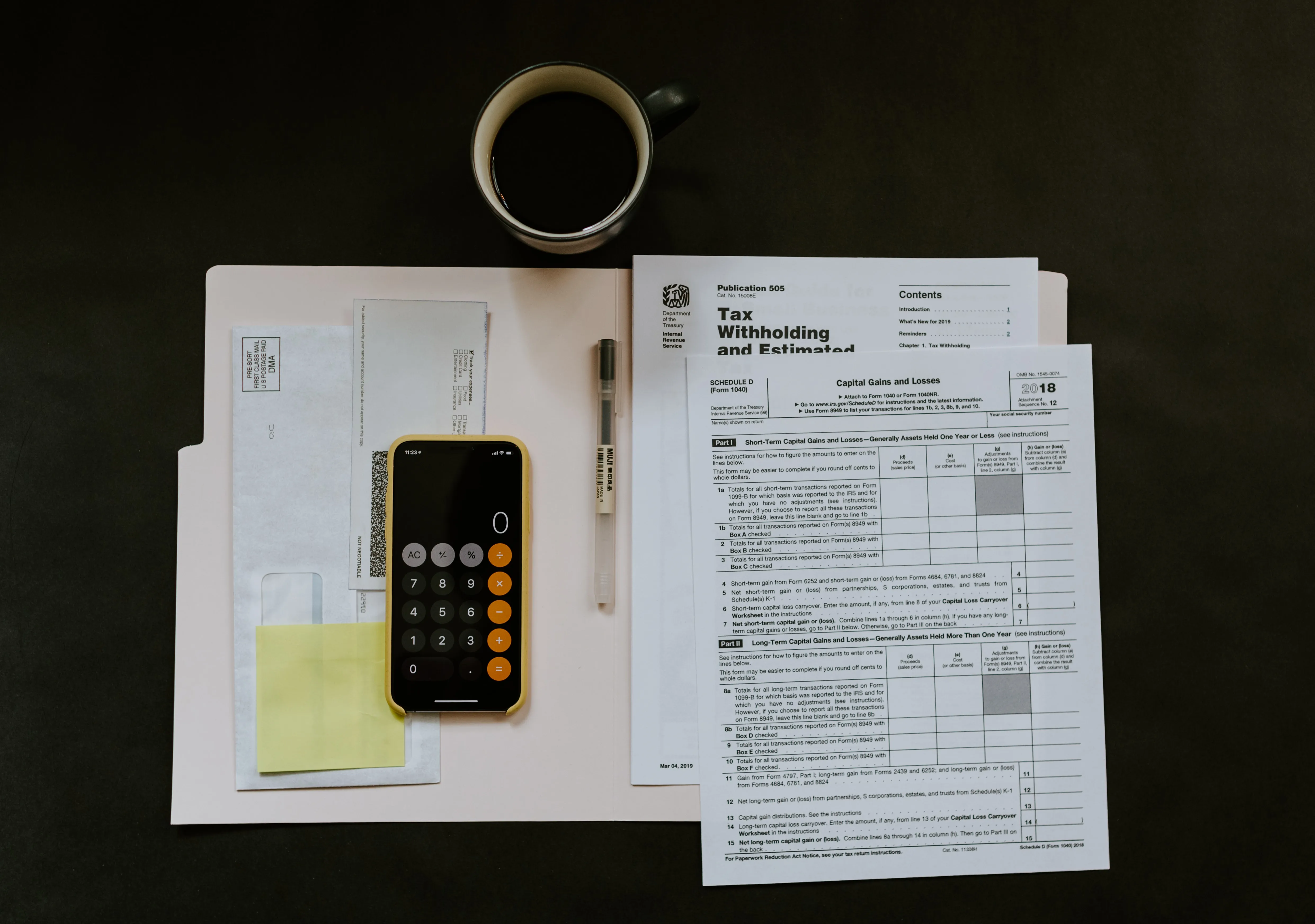

2. Budgeting helps you to gain control of your money

The budget is the milepost on your financial roadmap.

It helps you to

- navigate gracefully and with ease toward your financial goals.

- Keep track of your expenses.

- It tells you when you are on the right path and sliding off.

- Understand your cash flow. And allow you to know how much money you earn and spend and on what activity.

>> How much wealth do you need for retirement?

3. A budget helps you to create some probable projections of the future

Budget is more than just keeping track of money in and out. It also helps you to analyze your money patterns and gain a valuable understanding of your financial life. You can create a probable projection of your financial future and plan things accordingly.

4. A budget helps you reach your goals

When you know in and out of your money, you can divert your focus and money to the things necessary to you.

Everyone has different money goals. It varies from building an emergency fund, saving for a house down payment, paying for credit card debts, paying off a mortgage, saving for children's education, investing for retirement, and so on.

What are your money goals?

A budget allows you to create a plan and track progress to ensure that you are reaching your money goals faster or on time.

>> Top Tips for easily sticking with Your Family Budget

5. Budget prevents overspending

When you don't have a budget, it's way too easy to overspend.

But when a budget is there to guide you, you can gain control of your expenditures. You will be able to know when you are already overspending or not. It limits your spending power for future purchases and requires you to apply more money to save and invest every month. Plus, you become attentive to the blow of every money decision that you make.

6. A budget helps you to save money

When you budget, a primary task is to assign money to meet specific needs. In addition, it allows you to ensure that you are automatically investing/saving a certain amount of money every month.

This simple task is all you need to begin building wealth.

7. Budget is NOT a restriction but a freedom

If you're worried about restricting your spending, consider what life would be like if you had to apply more and more of your paycheck to repay credit cards every month without end!

>> How to Start a quick family Budget with confidence

When you have the budget, you know where and how much money will go. Budgeting does not require crazy restrictions. You get to decide how much money you spend to suit your needs. Your needs determine your budget. You can put however much money you want in each spending category. This way, you can safely plan and spend on things you love without second guessing.

Budgeting is not about simply limiting parts of your life. You'llInstead, you'll learn how to experience new opportunities in saving and spending money to have more fun.

The truth is budget gives you the kind of assurance and control that you need to keep track of your expenses. In this way, you can be surer that your spending activities are based on reason and plan, not just sheer indulgences and impulses.

Once you get into the habit of budgeting, frivolous spending that leaves you financially "overdrawn" becomes a thing of the past. You'll enjoy the freedom it brings you when you always have money to spend on the things most important to you.

Recommended

12 Keys to the successful family budget

Fretless family budget

16 Budgeting tips every family needs to know