Fretless family budget

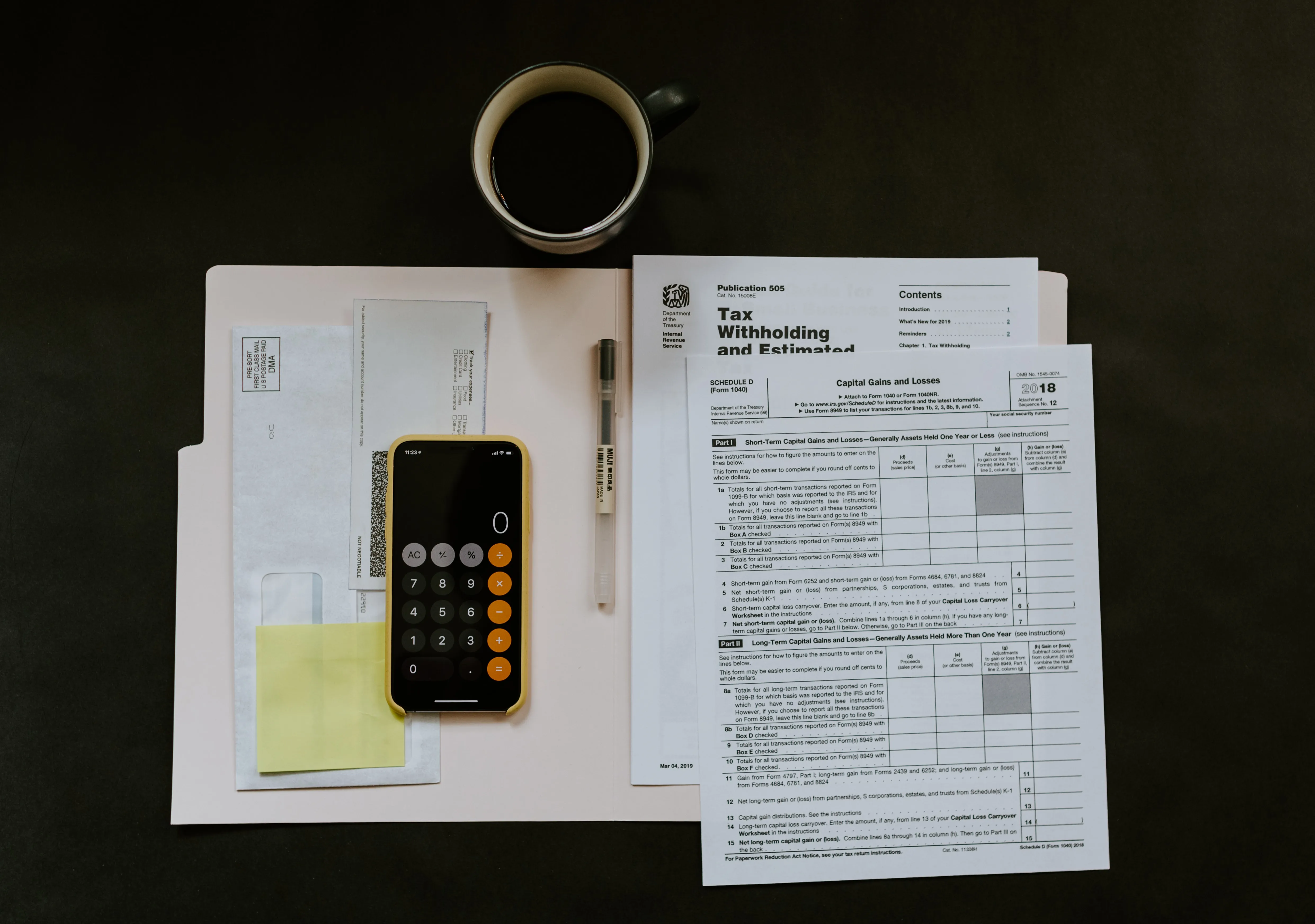

How do you manage money in your family? Is it just money that comes in and goes out without thought, or are you intentional about your purchases? Many young families fell into this trap. When they start earning good money, it's tempting to go and splurge money on everything they want. By the time they realize the mistake, it's often too late, and they find themselves already in credit card debt. For some, the idea of a budget often needs to be clarified. It is frustrating to see how hard it is to do a budget and realize that with one wrong purchase, you can ruin the entire thing. It has been a perennial headache for most homemakers.

It is about time to overhaul the way people look at budgeting. It can be a great way to keep track of your family's expenditures and help you evaluate the things on which you spend the lion's share of the family's earnings.

>> 7 Reasons why you should budget your money effectively

What is a budget?

A budget is a tool for handling your finances by controlling the family's expenditures so that money is enough for paying up bills and still ensuring that savings are set aside for future expenses - vacations, children's education, or even retirement.

Try these simple steps in preparing a no-fret family budget, and see the benefits of intelligent spending.

1. Gather three months of your pay stubs and get your average monthly earnings.

2. Take out three months of your monthly bills. Do this for fixed expenses like rent, phone bills, car payments, and other monthly loans. Then, add them up and get the average. Do the same for other expenses like groceries and credit card bills.

3. Evaluate the results of your computations.

Looking at your average monthly earnings against your fixed and variable monthly expenses, think of some ways to economize. Cut back on some unnecessary items.

4. Knowing the facts about your income and expenses, develop a family budget and try to stick to this monthly budget.

5. Now that you have a monthly budget, set up a savings account. Then, save up by making regular deposits to this account.

6. Keep track of this monthly family budget to see if it works for you. Try to fine-tune this budget's "rough edges" as you go along.

7. If you can get hold of a personal budgeting software or spreadsheet application to keep a record of your budget, the better. It will make organizing your expenses very easy.

These are the basic steps in developing and implementing a no-fret, easy to stick to monthly family budget. Of course, each family has diverse needs and wants. You can build your monthly budget depending on your family's financial background and needs.

No matter how you do it, focus on the result, which is building savings that leads to a bright and financially stable future for your family.

Recommended

Start a family Budget with confidence

12 Keys to the successful family budget

16 Budgeting tips every family needs to know

How to easily stick with Your Family Budget